More Educated, Fewer Homeowners, Fewer Married with Children

Do long-term demographic trends pose a challenge to the residential real estate market? Today’s 30-year-olds are more educated and more likely to be working than those from 1975. But, they are also less likely to have a moderate income, a home of their own or be married. What does it all mean to the future of housing?

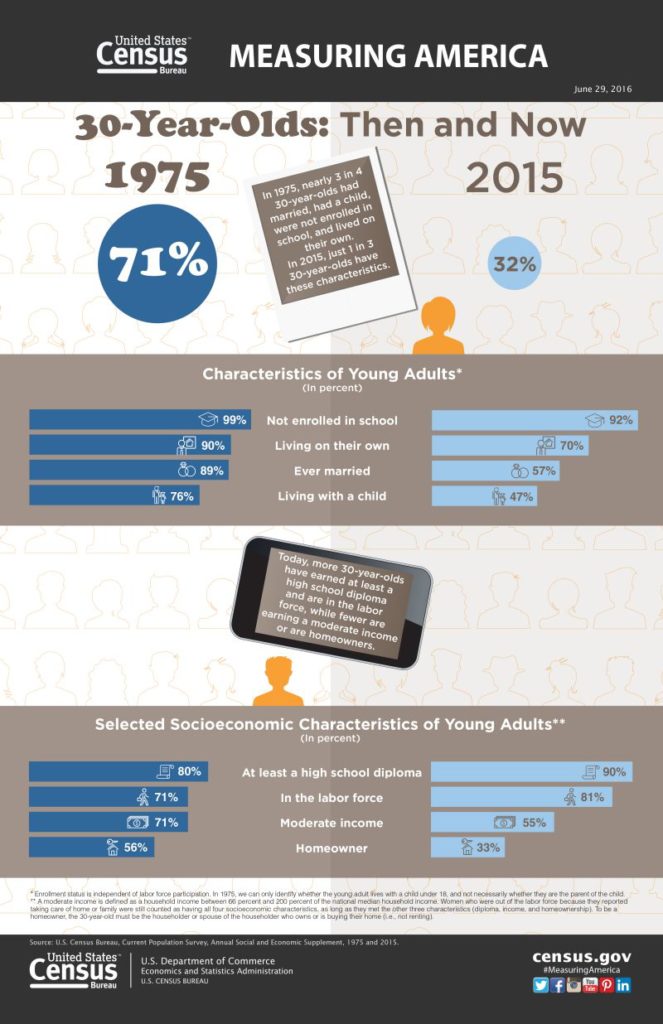

The U.S. Census Bureau’s collection of detailed demographics and socioeconomic statistics on Americans provides us with useful insights on an important group of first-time home buyers: those in their late 20s or early 30s. This “Measuring America” infographic highlights eight significant trends among this group as it compares to their peers from 40 years ago.

In 1975, nearly almost three out of every four 30-year olds had married, had at least one child, and lived on their own.

Fast forward to 2015.

Most astounding — unless you happen to have a 30-year-old son or daughter — is that only one in three 30-year-olds have the same characteristics today.

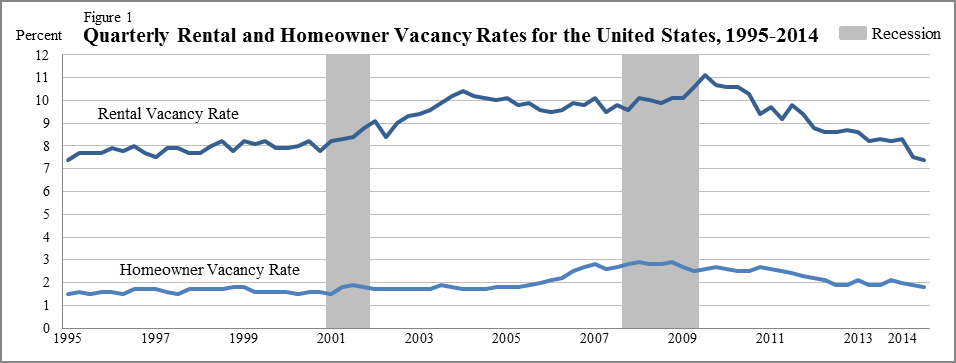

As the “typical” new family formation occurs later in life, expect to also see a shift in the expectations these families will have as to their housing. It certainly means longer periods of living at home with parents as well as more rental housing. As these families are starting later, it also likely means fewer “starter homes” and less home turnover. Expect to see more families looking to purchase a “forever” or “here to stay” home rather than trading up.

Another important shift is related to income. In 1975, 71% of 30-year-olds earned income at a moderate level. As a result, these young adults had the financial stability to own a home and qualify for a mortgage. Today, only 55% of 30-year-olds earn income at a moderate level, making it more challenging for them to qualify for a mortgage and buy that first house.

Should the single-family, residential real estate market be alarmed by these trends?

On some levels, the direction of a number of these trends has been exhibited since post World War II: college-educated men and women tend to get married later and thus have children later in life; the country has seen a tremendous increase in the number of college-educated adults over the last 70 years. Other trends have perhaps been magnified by the Great Recession, which delayed or disrupted the careers and earnings of many of these young adults. Still, others may be a reflection of changing social norms and the greater acceptance and practice of new family structures.

Ultimately, however, homeownership still remains a desired goal even among Millenials. According to a national survey conducted by Fannie Mae “millennial renters today have as much desire to own a home as the general population of renters.” Among 18-34-year-old renters, 91 percent would like to own a home at some point.

As younger workers realize wage gains and enjoy improved personal finances — and if interest rates continue to remain low — we should begin to see a moderate transition by this group to homeownership.

Sources: U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 1975 and 2015; Fannie Mae, National Housing Survey