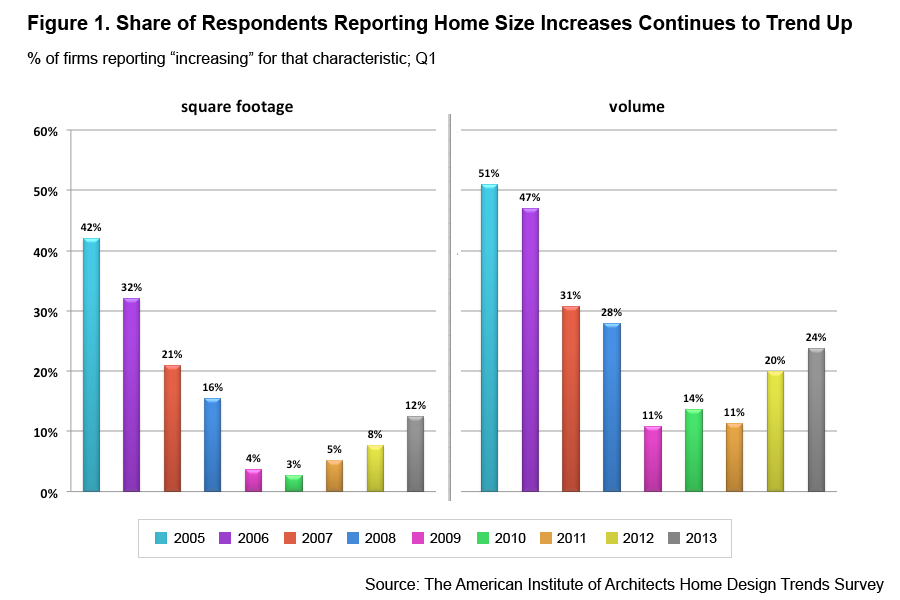

The good news is that people are starting to show more confidence in the recovering housing market in the United States, resulting in the strongest growth for residential architecture firms now at their strongest growth levels since 2005. The first-quarter AIA 2013 Home Design Trends Survey is in – featuring all the latest emerging trends about layout and design, home sizes, along with some property improvement ideas. We are now seeing larger homes on smaller lots and more outdoor features.

Architectural firms are reporting that the affordable home market is doing better, as are move-up homes and the custom, luxury home market. Even the condo and townhouse market segment has strengthened over the last year, while the home improvement market remains healthy. In fact, this segment never experienced weakness during the economic downturn, most likely because so the credit restrictions have had little effect on home improvements which are usually financed with cash.

The nation’s residential architects are reporting that home sizes will continue to show flex spaces and open designs along with the fact that people want to add to their outdoor living areas and blend indoor and outdoor space. Here is a surprise — people are finishing their basements and attics into living areas. Rebounding home sizes is more apparent in some markets than in others; 24 percent of respondents reported an increase in homes sizes compared to 22 percent in declines, and that also goes for remodels. But when it comes to entry-level homes increases are only at four percent.

We are seeing home design preferences for single floor designs and more informality, with open space designs that have partial wall divisions for flexibility. Homeowners are spending more on amenities than size. Home lot sizes are continuing to shrink thanks to a long term trend toward keeping homes affordable, but 63 percent of architects say that consumers are interested in creating expanded, but sustainable, outdoor living spaces as a property enhancement. People are putting in rainwater catchment and gray water reuse and low-irrigation systems.

The survey also points out signs of strong home improvement from architectural firms in the South and West, which is significant since these areas historically account for a disparate share of residential building. When it comes to firms in the Northeast and Midwest market, they are faced with older homes and typically slower population growth, therefore they see more investments in remodels and additions. During this past downturn, home improvement activity has held up better than the new residential construction.